Certified Government Financial Manager v1.0

Question 1

The objective of financial and non-financial performance measures is to:

- A. demonstrate probity and legality in the handling of public funds.

- B. demonstrate taxpayer preference in allocation of funds.

- C. assess policy and reasonableness of budget allocation.

- D. assess government performance and program accountability.

Answer : D

Question 2

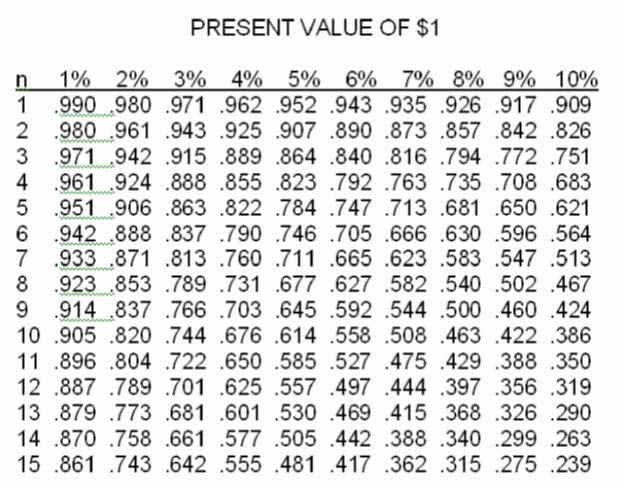

What is the present value of $25,000 to be received 10 years from today if the opportunity rate is 4%, the current tax rate is 1% and the expected future value is

9%?

- A. $ 9,706

- B. $10,550

- C. $15,295

- D. $16,900

Answer : D

Question 3

An agency receives miscellaneous revenue and investment revenue. The January beginning balance is $12,000. Monthly revenue is projected to be $2,000 and monthly expenses are projected to be $1,800. The agency plans to purchase a $10,000 90-day bond at par value on January 15. The agency has a $20,000 90- day bond that matures on February 15. What is the projected cash balance at the end of March?

- A. $11,400

- B. $12,600

- C. $22,600

- D. $32,600

Answer : C

Question 4

An audit tool used to examine financial data to detect fraud is:

- A. red flag detection.

- B. compiling data.

- C. data mining.

- D. regression analysis.

Answer : C

Question 5

Using purchasing cards for contract purchases creates efficiencies for all of the following EXCEPT:

- A. detection of fraudulent purchases.

- B. savings in transaction costs.

- C. improved cash flow for the vendor.

- D. streamlining payment in the accounts payable system.

Answer : A

Question 6

The U.S. Standard General Ledger will be used to record financial events for federal agencies, and common data elements shall be used throughout a federal agency for collection, storage and retrieval of financial information records according to OMB circular number:

- A. A-87.

- B. A-122.

- C. A-127.

- D. A-133.

Answer : C

Question 7

Governmental Organizations also provide funds to:

- A. Profit Organizations

- B. Non-Profit Organizations

- C. SMEs

- D. International Organizations or MNCs

Answer : B

Question 8

Which one of the following statements is the part of practices that States regulate?

- A. Preparation of specifications

- B. Advertising the letting of contracts and Project Scheduling

- C. Minority Goals

- D. All of these

Answer : D

Question 9

Federal and local Governments raise funds from________________ respectively.

- A. Tax-exempt Bonds and Bank Loans

- B. Bank Loans and Bonds

- C. International Market Investments and MNCs Capital Funding

- D. Foreign Reserves, Local Reserves

Answer : A

Question 10

FASAB has established_______ accounting Standards.

- A. 35

- B. 20

- C. 30

- D. 27

Answer : C

Question 11

The National Committee on Municipal Accounting (NCMA), sponsored by the Municipal Finance Officers Association (later Government Finance Association

[GFOA]), published in what is called, for obvious reasons, the "Blue Book." The third Blue book was titled as:

- A. Governmental Accounting, Auditing, and Financial Reporting

- B. Federal Accounting and Financial Reporting

- C. Blue book III

- D. None of these

Answer : A

Question 12

FASB (Financial Accounting Standards Board) is a ____________ organization and controlled and supported by a ______________, Financial Accounting

Foundation.

- A. Governmental Organization, Non-Profit Organization.

- B. Private Organization, Non-Profit Organization.

- C. Non-Profit Organization, Governmental Organization.

- D. Semi- governmental Organization, Private Organization

Answer : B

Question 13

_______________ had separate principles for ___________________ in the past.

I. Colleges and universities -

II. Hospital and health ""care entities

III. Voluntary health and welfare organization

IV. Nonprofit organization -

- A. Federal Government

- B. State Government

- C. Local Government

- D. Non-profit Organization

Answer : D

Question 14

Issuance of practice and consensus bulletins prepared by the AICPA"™s Accounting and Standard Executive Committee is done at _________ level of GAAP.

- A. 1

- B. 2

- C. 3

- D. Zero

Answer : C

Question 15

Federal Government requires accounting records on:

- A. GGAP-basis

- B. Non-GAAP basis

- C. It depends

- D. Both A&B

Answer : C