Certified Credit Research Analyst v1.0

Question 1

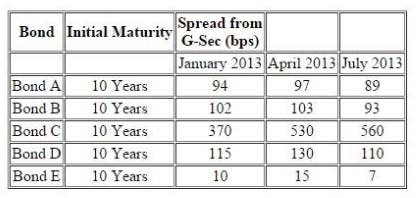

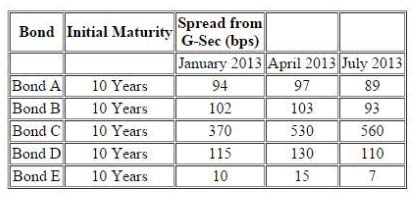

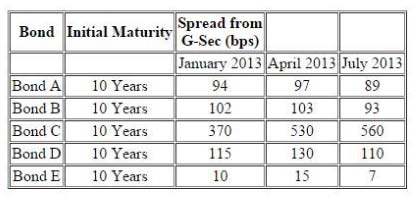

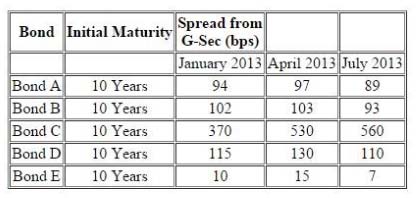

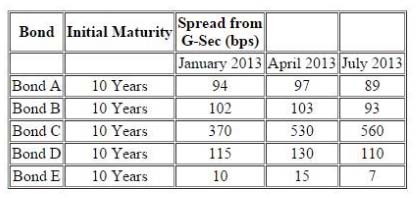

The following information pertains to bonds:

Further following information is available about a particular bond "˜Bond F"™

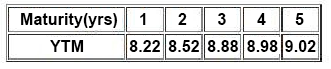

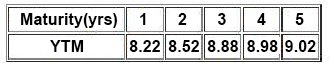

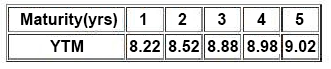

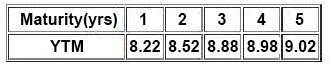

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the G-Sec has not changed?

- A. There has been credit spread compression, which means the spreads have declines, which can be lead indicator of oncoming economy stress.

- B. There has been widening of credit spread, which means the spreads have increased, which can be lead indicator of oncoming economy stress.

- C. There has been widening of credit spread, which means the spreads have increased, which can be lead indicator of oncoming economy stress.

- D. There has been credit spread compression, which means the spreads have declines, which can be lead indicator of oncoming economy boom.

Answer : C

Question 2

The following information pertains to bonds:

Further following information is available about a particular bond "˜Bond F"™

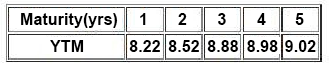

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Compute interpolated spread for Bond F based on the information provided in the vignette:

- A. 1.64%

- B. 0.43%

- C. 0.61%

- D. 1.46%

Answer : A

Question 3

The following information pertains to bonds:

Further following information is available about a particular bond "˜Bond F"™

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Following are the relevance of Industry Analysis:

Statement 1: Evaluating Industry risk is the first and foremost step for top down approach of analysis.

Statement 2: Industry Analysis is relevant for analyzing the industry life cycle, which is highly important from the perspective of an investor or lender.

State which is/are correct?

- A. Both are incorrect

- B. Both are correct

- C. Only Statement 2 is correct

- D. Only Statement 1 is correct

Answer : B

Question 4

The following information pertains to bonds:

Further following information is available about a particular bond "˜Bond F"™

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assuming the G-Sec has not changed from the time January 2013 to April 2013, what can you predict about the changes bond price and change in issues borrowing rates:

- A. Decrease and Increase

- B. Increase and Increase

- C. Decrease and Decrease

- D. Increase and Decrease

Answer : D

Question 5

The following information pertains to bonds:

Further following information is available about a particular bond "˜Bond F"™

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assume that the general market rates have increased. An issuer, Revolution Ltd has plans to roll over its existing commercial paper and forth coming reset dates for its floating rate bonds are very near. Which of the following ratios for revolution will get impacted?

- A. Interest Coverage and Return on assets

- B. DSCR, and Return on Assets

- C. DSCR, Interest Coverage and Return on assets

- D. DSCR and interest Coverage

Answer : A

Question 6

If XYZ Ltd. incurs (with purchase and installation of machinery) using cash, which of the following ratios will remain unchanged, if all other things remain constant?

- A. None of the three

- B. Asset Turnover ratio

- C. Current Ratio

- D. Quick Ratio

Answer : C

Question 7

Mr. Gopi, while teaching the CCRA course to students described Altman"™s Model and stated that following variables do exist for Altman"™s Model:

1. total debt/total assets,

2. retained earnings/total assets.

3. earnings before interest and taxes/total assets,

4. market value equity/book value of total liabilities,

5. sales/total assets

Exactly how many variables are incorrectly identified?

- A. Exactly Four

- B. Exactly One

- C. Exactly Two

- D. Exactly Three

Answer : A

Reference:

https://www.investopedia.com/terms/a/altman.asp

Question 8

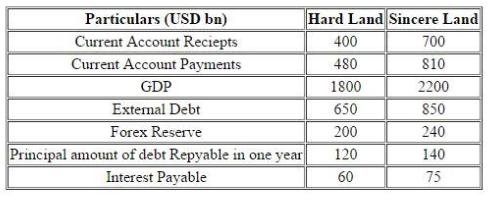

Two economies HardLand and SincereLand have provided following information with respect to their economies in USD Billion:

Based on the above information which entity is better in terms of current account deficit %?

- A. Sincereland by 583 bps

- B. Hardland by 56 bps

- C. Sincereland by 56 bps

- D. Hardland by 583 bps

Answer : B

Question 9

The longer the term to maturity of bond:

- A. term to maturity and price of a bond are not related

- B. The lesser is the risk associated with price of a bond

- C. The higher is the return from the bond

- D. The more risk in the price of a bond

Answer : D

Reference:

https://www.investopedia.com/university/advancedbond/advancedbond5.asp

Question 10

Loss assets should be written off. If loss assets are permitted to remain in the books for any reason, ______percent of the outstanding should be provided for.

- A. 150

- B. 75

- C. 100

- D. 50

Answer : C

Reference:

https://currentaffairs.gktoday.in/tags/provision-coverage-ratio

Question 11

Under an advance factoring contract, following flow of money takes place:

A: Factor pays a percentage of the invoice face value to the seller at the time of sale

B: The remainder of the purchase price is held by factor until the payment by the account debtor is made.

C: The cost associated with the transaction is paid upfront by the seller to the factoring agent.

- A. Only B

- B. A, B and C

- C. Only C

- D. Only A and B

Answer : D

Reference:

https://www.google.com/url?

sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=2ahUKEwjgyrT_jdzeAhXlAMAKHS5ACywQFjABegQIBBAC&url=https%3A%2F%

2Fwww.ansarbank.com%2FAssets%2FData%2Fuserfiles%2Ffiles%2FFactoring(zarineh).docx&usg=AOvVaw0OaoifqINnnvz3sRedVCii

Question 12

In Steepening short term rates ______relative to long term rate

- A. falls

- B. rises

- C. is independent of each other

- D. remains constant

Answer : A

Reference:

https://www.analystforum.com/forums/cfa-forums/cfa-level-ii-forum/91348766

Question 13

If you yield curve is humped and the medium rates drop, what will happen to the yield curve?

- A. It will move from negative to positive

- B. It will shift up in a uniform fashion

- C. It will become steeper

- D. It will flatten

Answer : C

Question 14

Which of the following statement is false?

- A. DEF Ltd. has received a speculative grade rating as its outstanding rating is B+

- B. Non-Convertible debenture of PQR Ltd. has a speculative rating since its outstanding rating is C

- C. ABC Ltd. short term is BBB- for its commercial paper

- D. XYZ has an investment grade rating as his outstanding rating is A1

Answer : B

Question 15

Which of the following is not one of the C in the 5 C Model?

- A. Capacity

- B. Capital

- C. Covenants

- D. Conditions

Answer : C

Reference:

https://www.investopedia.com/terms/f/five-c-credit.asp